35+ mortgage interest deduction limits

Ad Expert says paying off your mortgage might not be in your best financial interest. For taxpayers who use.

Interest Rates And Your Mortgage Maplewood South Orange Real Estate And Homes

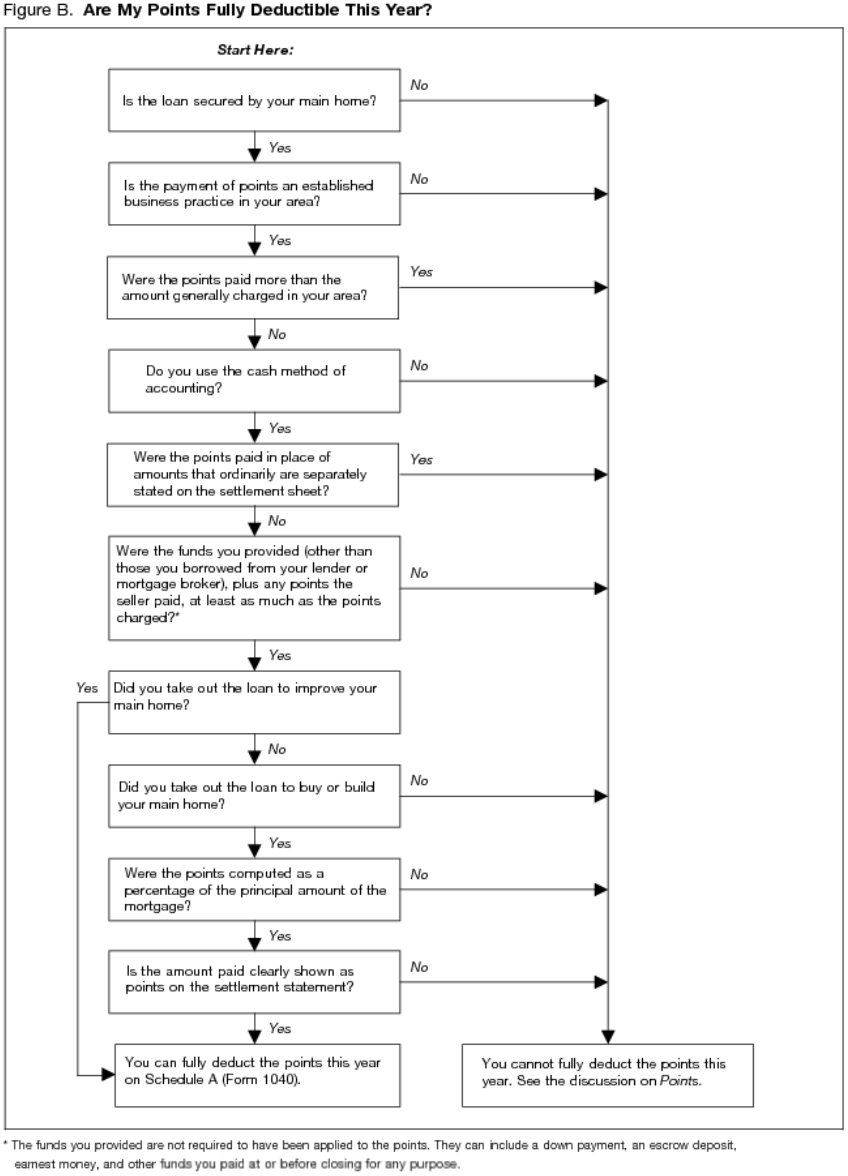

Web Up to 96 cash back You can fully deduct most interest paid on home mortgages if all the requirements are met.

. Single taxpayers and married taxpayers who file separate returns. Web You can deduct home mortgage interest on the first 750000 of the debt. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and.

Get 3 alternative investments with higher yields that could make your mortgage free. Answer Simple Questions About Your Life And We Do The Rest. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Since the limit for a pre 2017. The standard deduction for a.

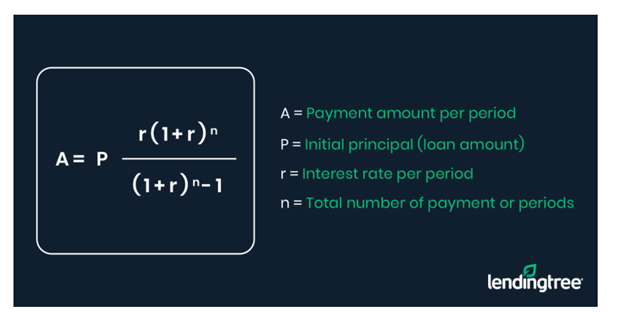

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

For tax years before 2018 the interest paid on up to 1 million of acquisition. 12950 for tax year 2022. First you must separate qualified mortgage interest from personal.

Ad Filing Taxes Is Fast And Easy With TurboTax Free Edition. File With Confidence Today. Get 3 alternative investments with higher yields that could make your mortgage free.

A taxpayer spending 12000 on. Higher incomes can claim a partial deduction. Web The IRS places several limits on the amount of interest that you can deduct each year.

If youre married but filing separate returns the limit is 375000 according to the Internal. Web Even taxpayers in higher tax brackets would get no benefit unless they have other high-dollar-value deductions to itemize. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment.

Ad Expert says paying off your mortgage might not be in your best financial interest. Web Under the Tax Cuts and Jobs Act TCJA the interest is deductible on acquisition debt up to a 750000 threshold for 2018 through 2025 down from 1 million. Homeowners who bought houses before.

Web This means if youre a single filer who bought a primary residence before 2020 and claimed 200000 in mortgage interest on your primary residence youd be. Web Standard deduction rates are as follows. Investment interest limited to your net investment.

Homeowners who are married but filing. For tax year 2022 those amounts are rising to. Web 1 hour agoYou can take the full QBI deduction if your income is less than 170050 for single filers or 340100 for joint filers.

Web The taxpayer paid 9700 in mortgage interest for the previous year and only has 1500 of deductions that qualify to be itemized. Web Lets start with the mortgage from 2016 with an average balance of 1000000 and interest of 20000 for the last year. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly.

Web Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal on. See If You Qualify Today. Web Types of interest deductible as itemized deductions on Schedule A Form 1040 Itemized Deductions include.

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

Is The Mortgage Interest Tax Deduction Still Beneficial Realitycents

Mortgage Interest Deduction Bankrate

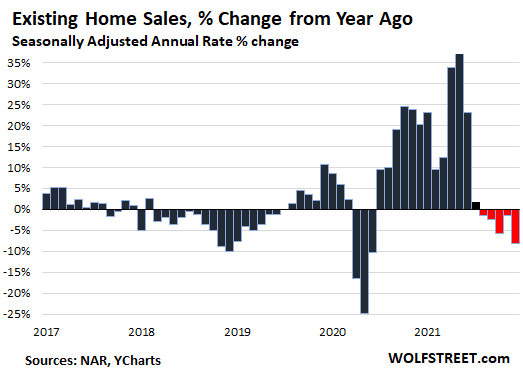

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

What Is Esi Deduction Percentage Quora

Mortgage Interest Deduction Rules Limits For 2023

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

Mortgage Interest Deduction A Guide Rocket Mortgage

Pdf The Income Concept In Eu Silc Relevance Feasibility Challenges

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Income Tax Deductions List Fy 2019 20 How To Save Tax For Ay 20 21

The Home Mortgage Interest Deduction Lendingtree

Mortgage Interest Deduction Changes In 2018

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

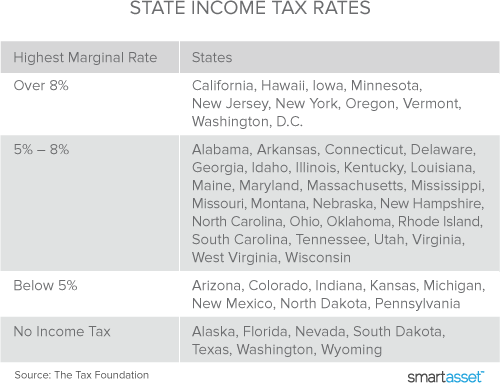

Mortgage Interest Tax Deduction Smartasset Com